The agency Bloomberg published a list of currencies of 11 countries, which, perhaps, will depreciate after the tenge of Kazakhstan. The reason for the devaluation of those who fall into the "black list" of currencies are strong trade and economic ties with Russia and the weakening of the yuan in August. The latter led to large fluctuations in the financial markets and put countries competing with the world's second largest economy at a disadvantage.

We present to you a rating of currencies close to the depreciation in 2015 of .

11. Ringgit, Malaysia

11. Ringgit, Malaysia

Reserves for maintaining the Malaysian currency have fallen below $ 100 billion for the first time since 2010.The consequence of this was a decrease in the ringgit rate to a minimum since 1998.

Reserves for maintaining the Malaysian currency have fallen below $ 100 billion for the first time since 2010.The consequence of this was a decrease in the ringgit rate to a minimum since 1998.

10. Kwacha, Zambia

The country is closely connected with China, supplying it with copper ore. Copper is the backbone of Zambia's exports( about 70%).

The country is closely connected with China, supplying it with copper ore. Copper is the backbone of Zambia's exports( about 70%).

9. Cedi , Ghana

Is a major exporter of oil, although the main problems of the republic are not due to the cheapening of this mineral, but with rising inflation, fiscal imbalance and rising public debt.

Is a major exporter of oil, although the main problems of the republic are not due to the cheapening of this mineral, but with rising inflation, fiscal imbalance and rising public debt.

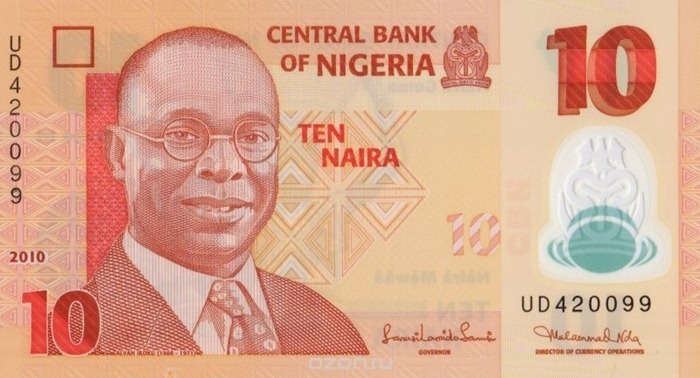

8. Naira, Nigeria

This country is the largest oil exporter in Africa, so its revenues are heavily influenced by world prices for "black gold".In early 2015, Naira fell to the dollar at 7.8%.And it is expected that the currency of Nigeria has not yet reached the "bottom" and will fall by more than 20% over the next year.

This country is the largest oil exporter in Africa, so its revenues are heavily influenced by world prices for "black gold".In early 2015, Naira fell to the dollar at 7.8%.And it is expected that the currency of Nigeria has not yet reached the "bottom" and will fall by more than 20% over the next year.

7. Lira, Turkey

Political factors play a role in the devaluation of the lira. The second parliamentary elections can be held in the country if political forces fail to find a compromise.

Political factors play a role in the devaluation of the lira. The second parliamentary elections can be held in the country if political forces fail to find a compromise.

6. Pound, Egypt

Egyptian authorities restricted access to foreign currencies to investors, beginning with the events of 2011( "Arab spring").Traders bet that the Egyptian currency will weaken by 22% per year.

Egyptian authorities restricted access to foreign currencies to investors, beginning with the events of 2011( "Arab spring").Traders bet that the Egyptian currency will weaken by 22% per year.

5. Som, Kyrgyzstan

The weaker the tenge, the lower the cost of catfish. The reason is the long-standing economic ties of this country with Kazakhstan.

The weaker the tenge, the lower the cost of catfish. The reason is the long-standing economic ties of this country with Kazakhstan.

4. AMD, Armenia

Over the past 12 months, it lost 15% of its value, as 25% of the country's exports go to Russia.

Over the past 12 months, it lost 15% of its value, as 25% of the country's exports go to Russia.

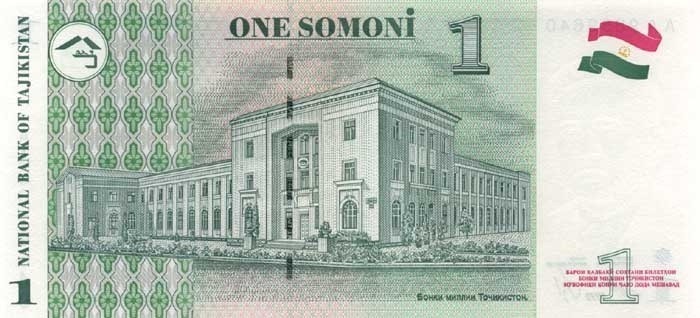

3. Somoni, Tajikistan

Rating of currencies that can depreciate continues the national currency of Tajikistan. This country and Kazakhstan are long-standing economic partners, the latter accounts for about 11% of exports. Devaluation can be from 10 to 20%, according to experts of financial organization Skandinaviska Enskilda Banken( SEB).

Rating of currencies that can depreciate continues the national currency of Tajikistan. This country and Kazakhstan are long-standing economic partners, the latter accounts for about 11% of exports. Devaluation can be from 10 to 20%, according to experts of financial organization Skandinaviska Enskilda Banken( SEB).

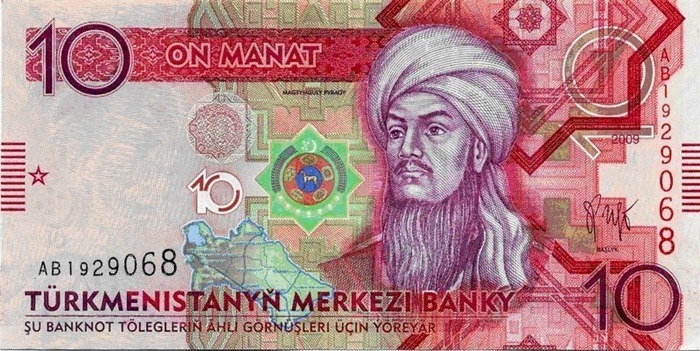

2. Manat , Turkmenistan

The country is one of the largest oil exporters and has strong economic ties with Russia. In January 2015, the devaluation of the national currency of Turkmenistan was 19%.And within half a year can make up all 20%.

The country is one of the largest oil exporters and has strong economic ties with Russia. In January 2015, the devaluation of the national currency of Turkmenistan was 19%.And within half a year can make up all 20%.

1. Rial, Saudi Arabia

"Country of two mosques" is known as the world's largest oil supplier. It has ample opportunities to withhold PEG( the ratio of the stock price to earnings per share), according to Deutsche Bank AG.But the devaluation of rial is possible because of the fall in the cost of crude oil to a seven-year low. The reduction in the value of the currency of Saudi Arabia for the year may be 1%.

"Country of two mosques" is known as the world's largest oil supplier. It has ample opportunities to withhold PEG( the ratio of the stock price to earnings per share), according to Deutsche Bank AG.But the devaluation of rial is possible because of the fall in the cost of crude oil to a seven-year low. The reduction in the value of the currency of Saudi Arabia for the year may be 1%.